The Government has recently announced two key changes that will affect your position as a

buy-to-let landlord. Further information from the Government is expected, but here are the

high-level details as MPC understand them, and how the changes might affect you.

Change 1: Tax relief on interest payments

Current tax rules state that the amount of interest you pay on your mortgage is an acceptable

deductible expense, whether you have used an interest-only mortgage, or a repayment mortgage. So if

you are a higher rate tax-payer, you benefit from 40% tax relief on the mortgage interest you’re

paying. Under the new rules, this tax relief will be capped at the basic-rate of tax, which is 20%.

This change is due to be phased in from 2017.

Change 2: Tax relief on ‘wear and tear’

You are also currently entitled to deduct 10% of your rental income as an expense for ‘wear and

tear’ if your rental property is furnished. From April 2016, the Government will replace this with

a scheme that means landlords can only deduct expenses they actually incur in relation to the

property. So for example, if you have had to buy a replacement washing machine, this will be an

acceptable deductible expense.

What is the impact of these changes?

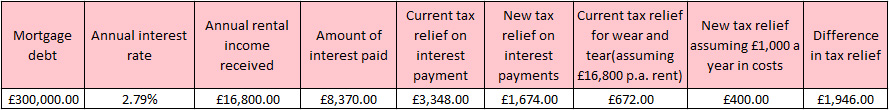

Here is a simple example of how the changes might affect you, given some of the following

assumptions:

- Your buy-to-let property was purchased for £400,000

- You have a 25-year interest-only mortgage of 300,000 at a rate of 2.79%

- You are a higher-rate tax payer

- You spend an average of £1,000 per year on improvements

- As the table below shows, these proposed changes will mean an annual loss of £1,946 in tax relief

Are there ways around it?

The Government has yet to publish any detail around these changes, and they are likely to be phased

in. However, it may be worth you considering the following as ways to mitigate the impact on your

profit:

- Put your property(ies) in a limited company. However, there is a

different tax regime, and there would be a cost of transferring your existing properties. Finance

products also differ and are more difficult to come by (although there may be innovation in the

mortgage market to cater for this event). - Put rent up to cover extra tax. It is highly likely that rental

income will increase annually for the foreseeable future anyway. However, you should be mindful of

the tax changes when negotiating rental increases with tenants. - Revert to shorter fixed-rate mortgage periods with lower interest

payments ie 2 year fixed rate, rather than 5 years.

If you would like discuss any of this in more detail, please do not hesitate to contact me.